A Data-Driven Blog Series by Speedinvest

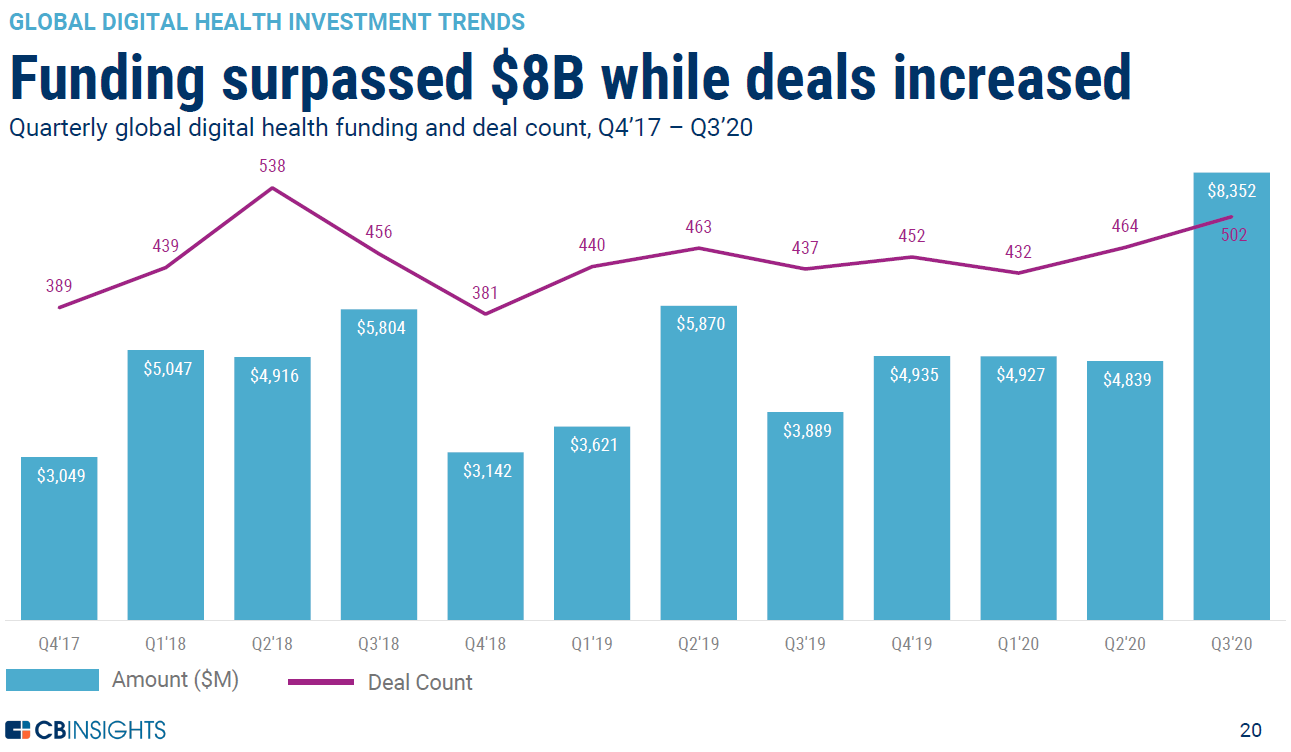

Global Digital Health funding has doubled in the last year to a new all-time record of $8.3 billion in Q3 2020, making this year the strongest ever for a relatively young sector. The buzz around telemedicine, online mental health care or remote patient monitoring has unleashed hectic investment activity in the US, like the Livongo-Teladoc mega-merger, Google’s $100M in workplace mental health provider Lyra and the Clover IPO — just to name a few.

(To be clear, this is a thin silver lining in an otherwise grim year. I’ve worked in healthcare and have friends and family on the front line. I just hope it’s over soon).

At Speedinvest we invested in pre-seed and seed Digital Health startups long before the current hype. We’re proud shareholders in 15 Digital Health startups from six European countries that cover a range of different fields and business models. Few other VC funds have such a broad Digital Health portfolio, and we’re happy to show (most of) it off here:

Not everyone is as bullish about this space as we are. Europe still lags far behind the US and Asia in investment levels and maturity of Digital Health companies.

A case in point, CB Insights’ 2020 edition of the DigitalHealth150 (their annual ranking of the “150 most promising Digital Health startups in the world”) only includes fifteen European companies, a measly 10%.

Capital flows into European Digital Health companies have also been far lower. While Digital Health funding has nearly tripled in Asia in the last quarter alone and in the US in one year, funding levels remained consistent in Europe, which currently only represents 4% of global Digital Health funding.

We can think of many reasons for the gap. TLDR: Europe has better public healthcare systems and therefore less impetus to innovate and invest in Digital Health; it’s more difficult to scale in a fragmented market; overall capitalization levels are very different.

The more immediate questions for us as a seed investor are:

(i) What’s going on in the European Digital Health market today, and

(ii) Where do future opportunities for Digital Health startups and investors lie?

To our surprise, no one has ever systematically analyzed the data. There is no comprehensive, data-driven overview of the European Digital Health market.

A Close Look at the Data on Digital Health in Europe

To shed some light on these questions, we spent the nasty summer of COVID-19 running the most comprehensive data analysis on Digital Health in Europe that we know of. We broke the space down by geographies, sub-verticals, funding trends and more.

This blog kicks off a series of posts that we’ll be sharing in the next weeks, including regional startup landscapes like our previous micro-map on Telehealth Startups in DACH, but far more comprehensive.

We’ll be covering the following geographies:

Here’s a link to our methodology if you’re interested. We’re only looking at software companies that work in or around health, have received funding and are still operational.

Here are three initial takeaways:

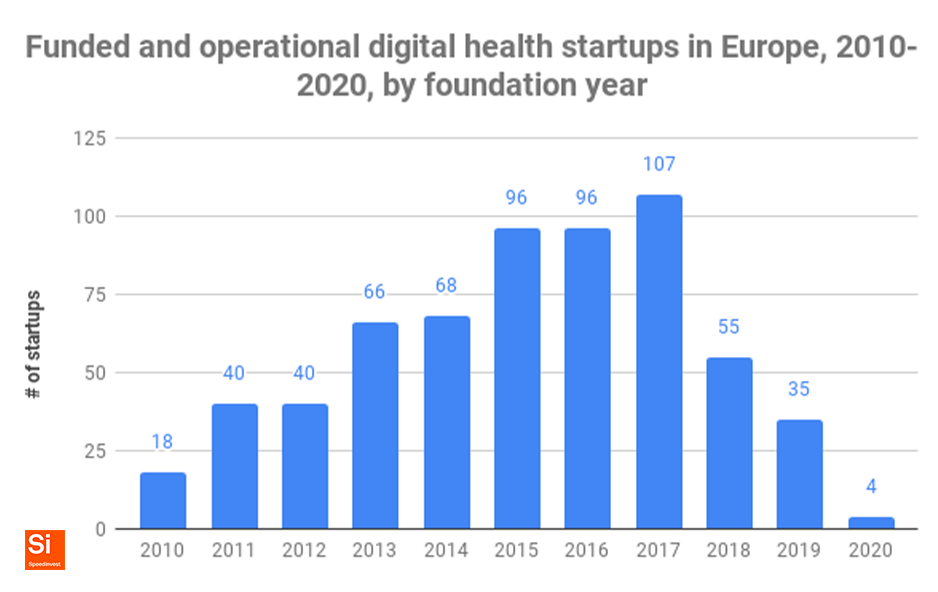

1. The category is still only taking shape. As we will unpack in detail in our next post, there are 626 funded Digital Health companies active across Europe today, including 18 startups founded in 2010 and 106 from the 2017 cohort. The numbers for 2018–2020 drop off because a lot of companies’ funding rounds have not yet been recorded (the reporting lag) or they have not raised funds yet. Still, note that >63% of funded Digital Health startups in Europe were founded in the last five years.

2. Company formation in Digital Health is accelerating quickly. A quick look at new, operational and unfunded Digital Health startups born in the last 3 years shows that in 2018 alone, 174 digital health companies were founded — a clear step up from 2017, even pre-pandemic.

Numbers for 2019/2020 are more tricky to find since many companies founded in that period haven’t entered official databases yet. As a proxy, we took a peek into our own CRM which shows that in 2019, we looked at a whopping 436 Digital Health companies. In the first three quarters of 2020, this number was 381. Naturally, these companies include several founded in prior years, as well as some non-health startups, but it does give us a sense of proportion.

3. Plenty of opportunity in a multitude of sub-verticals. “Digital Health” is not a vertical, it’s a collection of verticals. These range from consumer weight loss apps (like our portfolio company Second Nature), over B2B SaaS (like French unicorn Doctolib or our portfolio company Doctorly are building), to Deep Tech startups that apply AI for biotech and life sciences.

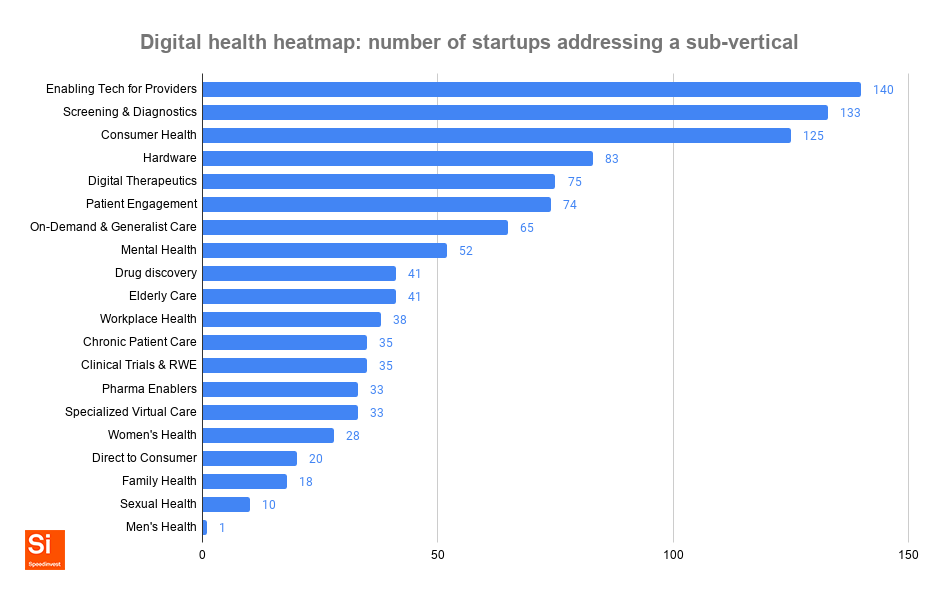

To analyze this diverse family of startups, we mapped all the topics or sub-verticals they cover. In a first step, we assigned tags based on all relevant categories a startup operates in (i.e. companies got tagged for multiple topics). The result is a heat map that shows which topics are hot in Digital Health in Europe (check the method blog on why we use these buckets):

Our heatmap shows that some topics are crowded, others largely unexplored. For example, a lot of startups focus on enabling/horizontal SaaS, consumer health services and software for diagnostic use cases.

Far fewer companies tackle care delivery for chronic conditions or focused demographics, like women or elderly people. In the US, these are well-established multi-billion Dollar “niches” that have given rise to huge players like Livongo or Omada Health in chronic patient care or the trailblazing Maven Clinic and Ask Tia in women’s healthcare. In Europe, these are areas that are ripe for development.

What’s next?

This was just a sneak preview! Check out our full analysis of 600+ Digital Health companies in Europe, including:

- Overall startup activity in the space

- Regional differences and characteristics

- Sub-verticals and trends within Digital Health

- Funding levels and trends across regions and sub-verticals