The energy sector is one of the largest sources of global emissions, accounting for almost 75% of all global CO2 emissions. Energy fuels our cars, heats our homes, and powers our industries. So it is necessary to decarbonise the sector by increasing the use of renewable energy sources in order to limit the rise in global temperatures to 1.5°C, the goal set by the Paris Agreement.

To achieve this, 40% of Europe’s total energy consumption should come from renewable sources by 2030. Solar energy has the potential to play a particularly key role, especially as the technology that supports low-cost photovoltaic (PV) systems continues to mature.

The efficiency of PV panels is measured in terms of the percentage of the sun's energy that the panel can convert into electricity. By this measure, the efficiency of solar panels has almost doubled in the past 10 years with modern PV modules reaching efficiencies of greater than 20%. Next-generation systems in labs have even reached about 40% efficiency, highlighting the still unrealized potential of this technology.

As for cost, the price of solar energy follows Swanson’s Law which predicts that the cost will decrease 20% for every doubling of the installed capacity. In practical terms, this has led to the price for solar energy dropping by 90% between 2010 and 2020.

According to Lazards LCOE (levelized cost of energy) calculation, utility-scale solar energy is already cost-competitive with conventional generation methods such as gas, coal and nuclear (min $29/kWh vs. min $65/kWh for coal). And, as described above, technological advancements will probably further push the price down.

Flipping the foreign policy script on oil and gas dependence

Energy dependence on authoritarian governments with poor human rights records is a long-standing problem. The top three oil producers after the United States are, in fact, Saudi Arabia, Russia and China. The security issues of this arrangement are clear.

A real-world example of this is the fact that the EU is still heavily reliant on Russian oil and gas, importing 40% of their gas from Russia. These payments then fuel the country’s government and fighting forces who are (at time of publication) engaged in a brutal invasion of Ukraine - the horrors of which are only now becoming apparent. At the same time, 45% of the country’s federal budget comes from taxes and export tariffs. So, what is currently a vulnerability in Europe could become Russia’s Achilles’ heel if investments are made that make it easier to turn away from oil, gas and coal.

With this in mind, the EU was quick to release the REPowerEU initiative. Its aim is to accelerate achieving Europe’s energy independence from Russian fossil fuel imports before 2030, while still keeping retail energy prices in check. Out of the six measures described in the initiative to reduce this dependence, two focused on increasing the amount of renewable energy and one specifically on solar energy.

But there is still a long way to go. Since 2019, the EU and UK have at least doubled their net solar productions. But while these growth numbers seem impressive at first sight, we need to put them into perspective.

The net solar PV capacity in the EU amounted to about 160GW in 2020. In order to reach the ambitious goal set out by the European Green Deal to become the first climate-neutral continent by 2030, this number needs to increase to 870GW. Considering the current average energy output of newly built solar plants in Europe, this would cover 6,745km² - or more than 2.5 times the surface area of Luxemburg.

But if certain problems are overcome, then a solar Europe is an achievable goal.

What are the primary obstacles to widespread adoption of solar tech?

The good news is that the bottlenecks in the adoption of social energy are manageable and can be overcome with the development of specific technologies. We see four main constraints to scale installed PV capacity: lack of availability of cheap solar panels, lack of qualified installers, high upfront cost for the installation, and balancing of the energy grid.

Lack of cheap available solar panels: In the past 20 years, China became the global manufacturing hub for solar panels, currently producing about 80% of global PV systems. Traditionally, the lower personnel cost in China outweighed the shipping costs to Europe. However, according to the Asia Times, a spike in energy and logistics costs has led to a 50-60% increase in price per module compared to 2021. Additionally, the availability of products declined by 50% in 2021.

Lack of qualified installers: Europe's race to renewable energy is already encountering a shortage in qualified solar installers despite the fact that installed capacity is predicted to grow in the coming years. In Germany alone, the gap amounts to over 100,000 skilled workers. Installation companies often have a waiting list for new clients that stretches out 5+ months. They even reject smaller residential projects altogether.

High upfront cost: Putting an average price tag on a rooftop PV system is challenging as there are many different variables that influence the cost. However, a ballpark figure is €20-30k for residential installations. Utility-scale plants are obviously significantly more expensive. While the investment pays off after about 10-20 years, the upfront cost can be a deterrent. This effect is becoming even stronger as governments across Europe are currently reducing subsidies for PV systems.

Energy grids and storage: Renewable energy sources have one main disadvantage to conventional fossil fuels: they are unpredictable. While solar and wind energy (currently the two fastest-growing renewable energy sources) are partially complementary - as solar panels operate during the day while wind tends to be stronger at night - current energy grids are not built with such strong variations in mind. Moreover, residential solar consumers are also energy producers feeding energy back into the grid, adding another layer of complexity. This requires new grid management solutions, as well as new short and long-term storage solutions.

Where startups can help

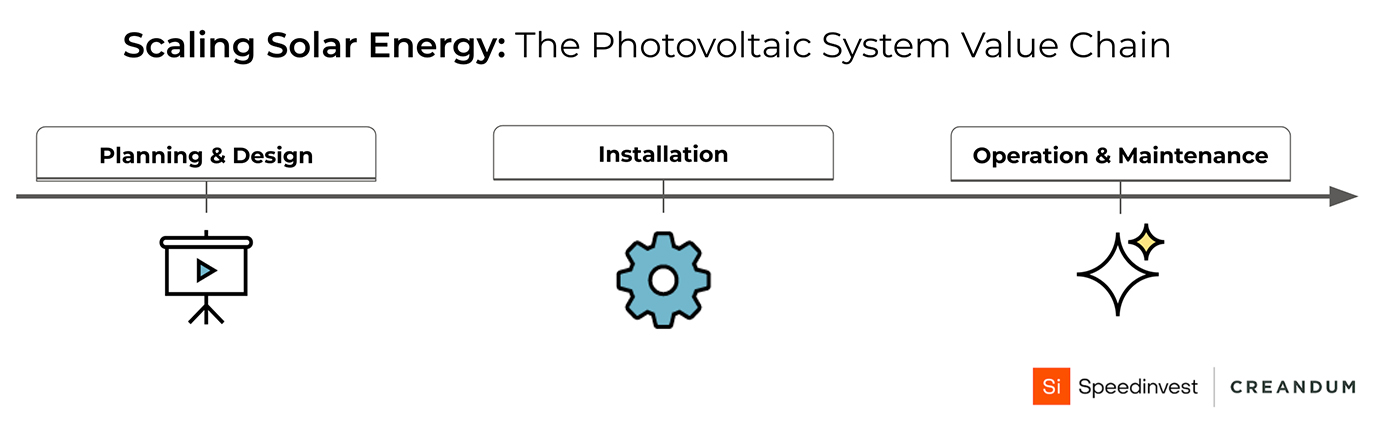

The European tech ecosystem is sprawling with solutions that tackle the bottlenecks described above. But what role can startups play to solve problems along the value chain of a PV system?

There are three main stages to produce solar energy. First, there is the planning & planning phase, where the first rough plan (size, tilt etc.) is made and then the detailed setup (electrical circuits etc.) are designed. In the second phase, this design is executed by an installer who sources the panels and instals them onsite. Finally, after the installation, the panels need to be operated and maintained.

There are two main use cases for solar installations: 1) rooftop solar and 2) utility-scale PV plants

- Rooftop solar is mounted on rooftops of buildings such as single-family homes, multi-family homes or commercial and industrial buildings such as hospitals, warehouses or factories.

- Utility-scale systems are mounted on the ground and are much larger in size. These plants often deliver several hundreds of megawatts, delivering enough energy to supply more than 50,000 households. This form currently represents about 60% of the total solar energy generation in Europe.

We have mapped out 50 European startups who we believe can help us to solve these bottlenecks.The aim of this landscape is neither to be exhaustive nor to rank startups, but rather to take a first stab at charting the most promising players in the European solar energy startup ecosystem. We’ve included both funded and unfunded companies that were founded in the last ten years. We’ve used Dealroom.com, Crunchbase and our own CRMs as the main data sources.

We have mapped them along the supply chain as described above: Solar-as-a-service startups enable real estate owners to install rooftop solar and take care of the process end-to-end, from planning to maintenance. Software for installers helps installers to operate in a more time and resource efficient way. For utility-scale systems startups in the Financing category help to match energy buyers or investors with developers, followed by the Planning & Design solutions and finally Asset Management companies help with the upkeep of the assets during their lifetime.

Planning & designing photovoltaic (PV) systems

As demand for solar PV is soaring, so is the need for planning and designing new sites as quickly and efficiently as possible. As mentioned above, there are two main phases: planning and design.

In the planning phase, rough designs are created based on the plant’s physical size and potential energy production (according to the orientation and tilt of the PV system). The designing phase entails a more detailed process of planning cable routes, inverters and mounting.

In the residential area, one of Rebase’s features helps to plan the required size of rooftop solar installation without the need to visit the site, reducing the required workforce. For utility size plants, the planning and designing phase is even more complex and labour intensive. Startups like Glint Solar help developers find the optimal project sites, while RatedPower and PVCase help to plan, design and optimise the engineering of a PV plant digitally.

PV plant design and planning software is likely to converge in the future. Much design software initially focused on one function, such as detailed designs for utility-scale plants. But this is changing. It is now slowly moving towards other design applications and across the value chain. This is partly driven by synergies in the technology used across different companies.

Another driver is that, the relatively limited size of the PV market in Europe, limits the growth potential of a tool that only tackles one niche. Hence, companies are increasingly expanding across the value chain towards an end-to-end solution. So we can expect that there will be a handful of dominant software companies in the planning and design space.

Yield management and financing

PV plant projects go hand-in-hand with large up-front investments. Being able to precisely predict the potential yield of a site is an important consideration for investors when calculating the potential ROI and, therefore, feasibility of the investment.

One of the main challenges in PV yield estimation is the accuracy of planning tools. An important factor when determining a tool’s accuracy is ray-tracing technology. This allows planners to simulate shadows and sun hours on a plant. However, this technology entails significant cost as a result of processing time and computing capacity required.

For utility-scale plants, PVSyst is the most used yield planning software, even though it does not use ray-tracing technology. Newer players in the market, like PVcase, are currently developing ray-tracing solutions and could become the new gold standard when simulating solar yield.

Another key to increasing the amount of installed utility-scale solar is to unlock new potential investors who are willing to invest into the technology, but do not have the means or the know-how to build a utility themselves. Startups like Alter 5 and Switchr then help PV projects get access to institutional and retail investors. Similarly, companies like Reel target industrial and commercial companies that want to invest in solar parks in exchange for guaranteed access to clean energy.

Improving yield modelling for PV plants will create trust with investors and unlock the further liquidity needed to carry the up-front investments.

Maintain and Optimise

Once a PV system is set up, it needs to be properly maintained to ensure optimal efficiency. This is particularly difficult with utility-scale plants that can have a surface area of several square kilometres. By detecting underperforming assets, startups like Skyfri and Greenbyte support the operation and maintenance of plants to ensure that they function at peak efficiency and profitability.

As Murshid Ali, the founder of Skyfri puts it: “Skyfri automates the maintenance of these plants, and makes sure they always perform well from the very beginning of each life-cycle to the end, regardless of size or location. These kinds of capabilities contribute to the necessary speed of building solar worldwide.”

Optimising the productivity and output of solar assets will be a major driver in reaching our solar goals. And we are just at the beginning of realising how software and tools like drones, satellite data, etc. can help to optimise output.

Bringing it all together: Rooftop solar-as-a-service

For rooftop solar applications, a category of startups has emerged which covers the entire value chain from planning and designing, to installing and finally running the PV system. This makes it particularly attractive, as each roof becomes a potential location for solar energy without requiring the owner to know how to manage the asset. At the same time, this reduces the personnel needed for solar installers.

The founder of Sunhero, Christopher Cederskog, notes that: "There are about 7,935 square kilometres of rooftops in Europe and, according to estimates by the European Commission, residential solar power could generate over 650 TWh of clean energy annually - or 25% of the EU's current electricity demand."

Cracking this market and gaining access to each rooftop will play a key role to decarbonize our grids. There are three main types of roofs: single-family homes, multi-family homes, and commercial & industrial rooftops (think malls, warehouses or factories). As each type of rooftop has its own requirements, specific solutions will have to be developed in order to make each business model work.

For single-family homes, companies like Enpal (DACH), Otovo (Nordics) and Sunhero (Southern Europe) - just to name a few - are tackling this segment in different geographies. Their end-to-end offerings include the handling of the administrative paperwork, planning, communication with the installer and operations of the PV system, as well as financing solutions (in some cases). This end-to-end approach radically reduces the barriers to entry for homeowners.

Startups tackling the multi-family homes segment have to offer features beyond the single-family segment, as the landlord also becomes the energy provider of the tenant.This usually entails the installation of smart metres and managing the energy contracts between the owner of the building and the tenants. Some examples here are Einhundert Energie and Ampeers Energy.

Lastly, Commercial & Industrial (C&I) rooftop solar has large potential, as the large surface areas can host several megawatts-worth of solar production. C&I installations also outranked residential installations in previous years. Despite the large potential, this sector can be particularly difficult to tackle, as commercial energy prices are lower in many countries. Startups like Voltaro and InRange tackle this area by, for example, pooling commercial rooftops next to each other in order to avoid grid fees.

Balancing a dynamic grid

The renewable energy transition requires a whole new set of capabilities. Currently, the electric grid distributes energy that is produced in a power station to the end customer at relatively steady levels.

In the future, however, production output levels will become highly dependent on the local sun and wind conditions, as well as fluctuating both with the day-night cycle and the seasons. Furthermore, as consumers become producers, feeding their overproduction back into the grid, the grid that used to be a one-way distribution network will increasingly need to accommodate two-way flows.

One key element of this balancing act is energy storage, the most common example of which is batteries. On the residential level, Sonnen helps to stabilise the amounts fed into the grid by providing batteries that integrate with the rooftop PV system, levelling out energy production and consumption.

There are many different concepts and technologies that offer solutions to prevent grid congestion, however, we will not cover them here as this is beyond the scope of this article. Nonetheless, we are actively looking into startups solving issues surrounding grid balancing and energy storage, as it is clear that this tech will play a vital role in the energy transition.

The future of solar energy in Europe

While many challenges remain to reach the clean energy targets set forth by the European Green Deal, we’re still positive that the European startup ecosystem will come up with solutions for each of these bottlenecks.

There are three main macro trends that favour an increasingly fast expansion of solar capacity:

New regulations (Paris agreements, REPowerEU etc.), decreasing price per kWh for PV and, ultimately, the continuous rise in consumer awareness. These trends will increase not only the attractiveness of solar energy, but also the necessity to solve the problems that can come with scaling solar energy for both consumer and utility-scale systems.

That is why Europe will see many successful startups in all of the areas mentioned above, be it to help plan utility scale solar plants, manage residencial solar end-to-end, help asset managers optimise their PV systems, store energy, or solve grid congestion, etc.

As the industry further develops, there will be a need for new solutions to problems that we have not yet encountered. This includes end-of-life management of PV systems as a large number of solar panels and batteries will have to be disposed of and, ideally, recycled.

We acknowledge that there are innovations in the solar space that we did not include in our map. Most notably R&D and material advancements on the hardware side which will lead to even higher efficiency at lower prices. We did not include such solutions as they do not (yet) have enough experience yet to judge their quality and potential impact.