Climate change is here. We’re at the stage where we need our best and brightest minds to come up with solutions to mitigate the fallout from climate change. Up to this point, we’ve relied heavily on software solutions.

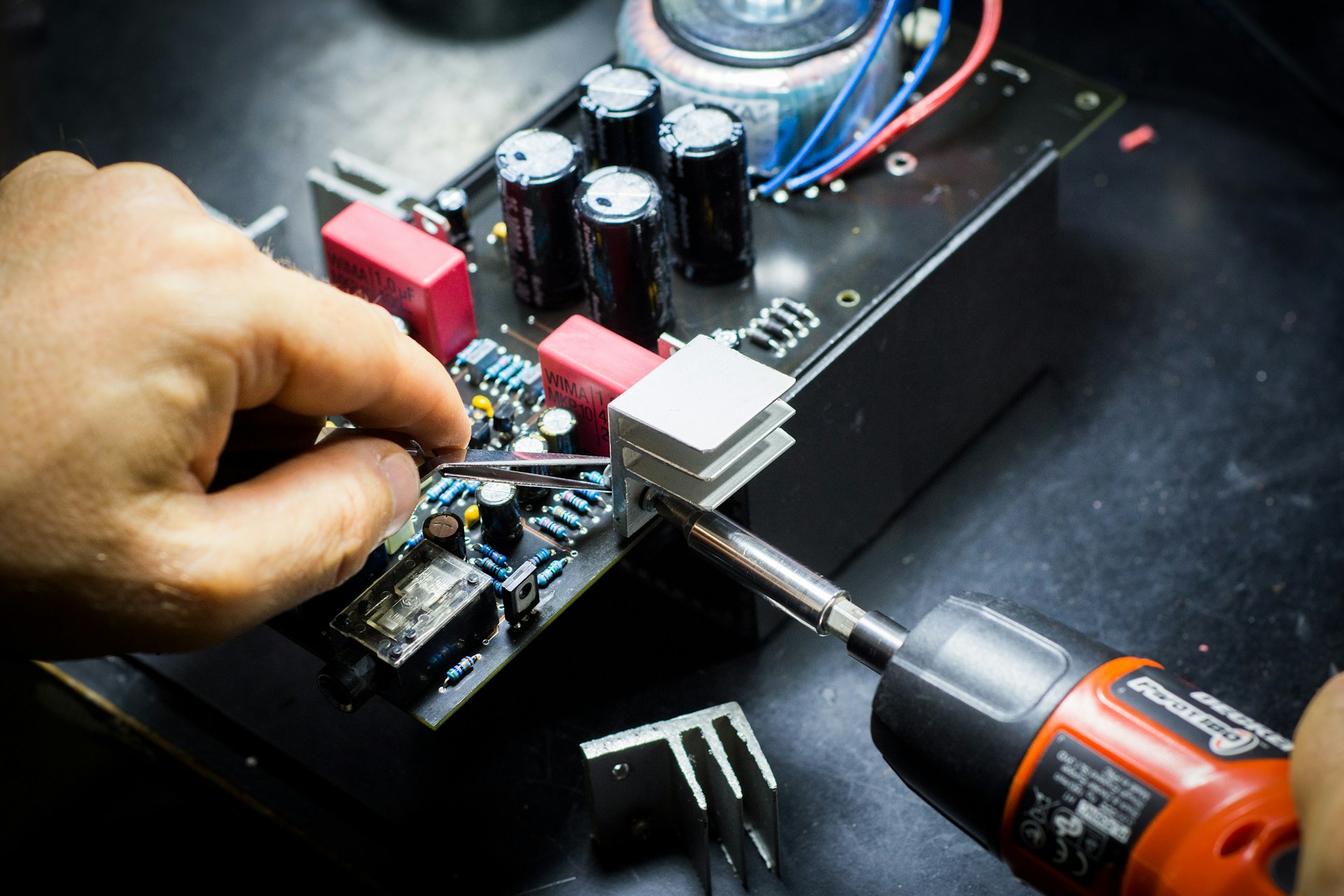

But building software to reach our climate goals will only take us so far. With climate change being caused by physical actions and emissions, we require physical solutions to fix it. Scaling up hardware solutions to decarbonize our economies has never been more relevant.

However, the journey of building hardware businesses is characterized by low margins, long timelines, low capital efficiency, and a lack of funding. This is not without reason: The story of Cleantech 1.0 serves as a cautionary tale, where huge investments in green technologies like solar panels and biofuels ended up losing significant amounts of money. This has reinforced the notion that investing in hardware comes with many difficulties.

That’s why we partnered with Norrsken and Planet A Ventures to create a comprehensive playbook with all of the strategies, insights, and resources you need to kick off your climate hardware journey. We interviewed dozens of experts, surveyed 118 investors and 142 founders, and took learnings from NetZero insights, covering 3,600 climate hardware funding announcements in Europe between 2015 - 2023, and answered questions like:

- How can you find the best business model that resonates with your customers?

- How do you navigate the complex funding landscape?

- How do you put together a winning team?

- How should you approach your sales and go-to-market strategy for your stage?

- How should you measure (and communicate) your impact to customers and investors?

We break down the five key takeaways of the playbook below. For all the numbers and insights, check out the full playbook.

Aim for business models that reduce capital intensity and increase the share of recurring revenues

Anything is better than one-off sales with large customer acquisition costs. Keep in mind that:

- Licensing is a tried-and-tested strategy, but not one that will work in every industry. Many founders think about licensing as a revenue model from day one, but the market often hesitates to adopt technologies that haven’t been proven in practice. Therefore, make sure to not move towards licensing before the technology is fully operational and well-tested.

- Do not lock in product prices based on market averages before fully understanding the production costs. The actual costs might be higher than anticipated, making it difficult to renegotiate prices if they are already fixed in off-take agreements. Aim for agreements that allow for pricing flexibility, perhaps based on cost-plus models, ensuring room for negotiation and adjustment.

Show a pathway to cost competitiveness

You should do a techno-economic analysis right at the start or right after you've found a potential technology. It’s really important to validate whether your technology can be the most competitive in the market, so make sure to:

- Develop a good understanding of your key inputs and the implications of managing and securing those as you scale up. Many climate technologies have a high degree of dependency on other technologies, e.g. carbon capture –– a risk that needs to be accounted for.

- Work with partners (contract manufacturing, industrial pilots). This can lower your CAPEX needs during the early stages of your company while you still prove your technology.

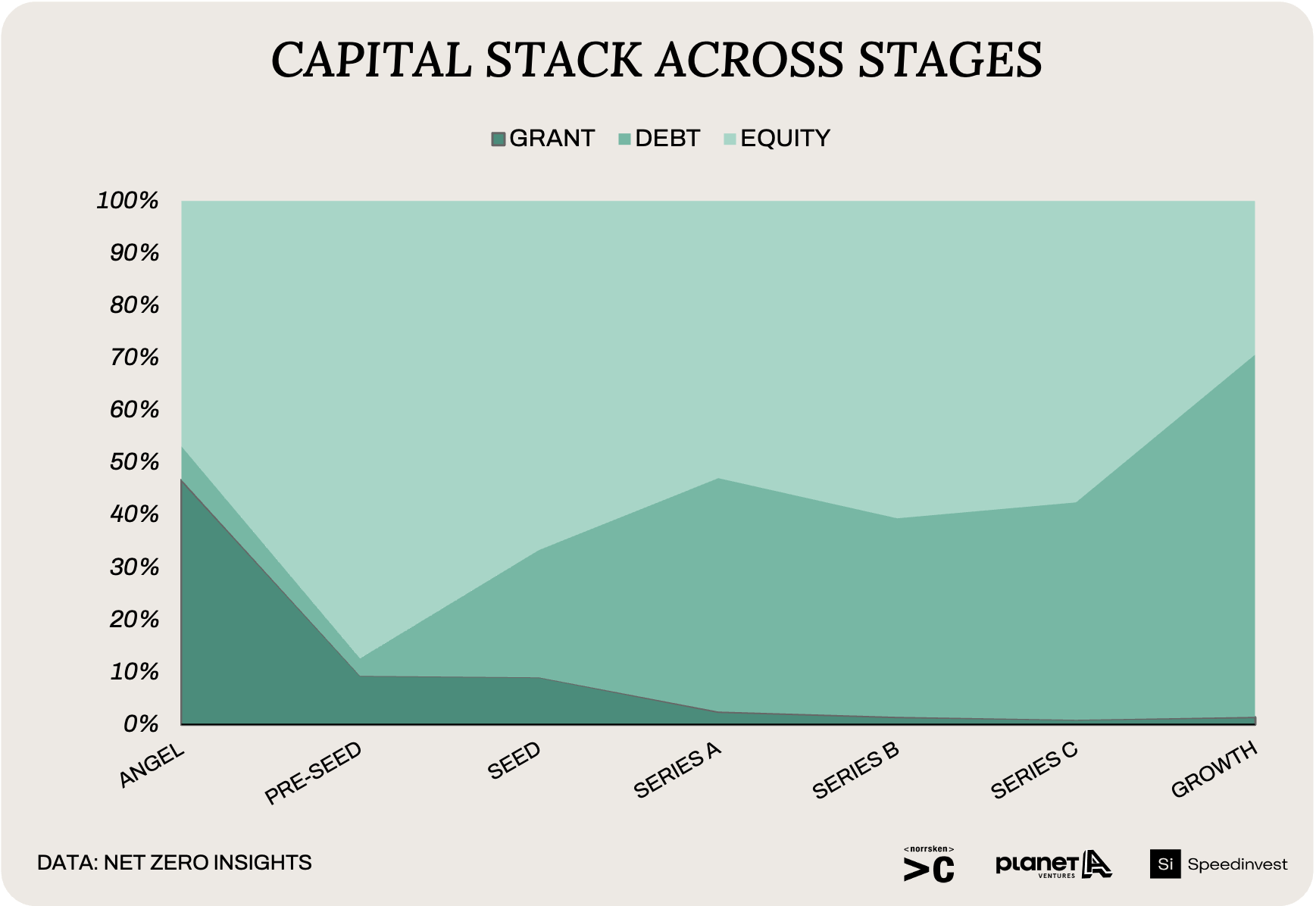

Explore different types of financing and understand different risk profiles of investors

Venture investors would often balance risk across different dimensions: Market Risk, Science Risk, and Scale Up Risk. While most investors would feel comfortable taking scale-up risk when there is no market risk, it becomes more challenging when both technology and off-take are uncertain. Therefore:

- Make use of grant and debt financing. Climate hardware companies no longer have to simply go through Seed, A, B, and C equity rounds, as software companies are used to, but should look into a wide variety of grants, debt financing, equipment finance, and additional money from infrastructure and asset finance.

- De-risk as much as possible. As founders, you have limited control over most risk factors, so focus on the ones that you can influence. Focus on de-risking market viability and showing early signs of market demand, such as LOIs and pilots. Successfully addressing the three main risks requires proactive planning, continuous monitoring, and a commitment to adaptability.

- During all of this, keep your cap table in mind. We heard time and time again in our investor interviews that a messy cap table is one of the most common shortcomings of climate hardware companies, especially in the case of university spin-outs. Consider its impact on founder dilution, management incentivization, decision making, and most of all, “smartness” of the capital from day one.

Plan for scaling from day one

Manufacturing operations at scale are at the core of many Climate Hardware startups, and unfortunately, there is a very high degree of variability depending on your specific case. Similar to mapping out your TRL, GTM, and capital stack, we recommended thinking about scaling your operations in the same way.

When thinking about building your first production facility, ask yourself the following questions:

- How do I produce the most capital-efficient way while I’m still proving my technology, using contract manufacturers and industrial partners?

- What is the amount of feedstock and electricity that I need as I scale up, and who can I work with to secure them ahead of time?

- Where should I plan my first major production facility, and how can I make sure to optimize for customer proximity, total costs (inc. subsidies) and timeline?

And don’t forget to think about navigating partners and policy. Setting up a production facility implies managing the different stakeholders, of which there are many, mostly with different interests. Be on top of it and build relevant personal connections with local governments and scale-up partners early on.

Add commercial hires to the leadership team early on

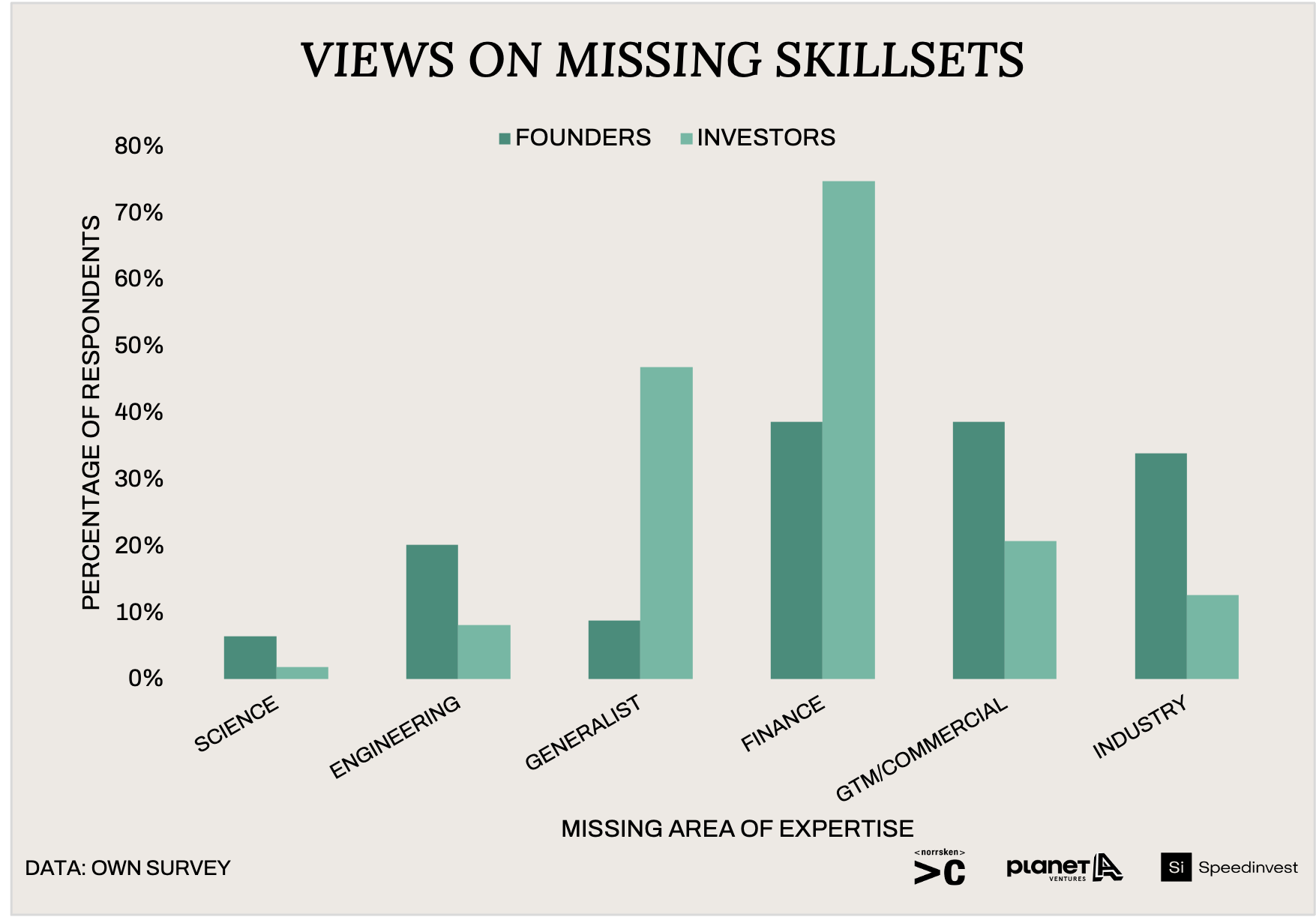

According to our survey and interviews, the lack of commercial expertise in a climate hardware startup’s team is one of the biggest shortcomings (named by founders and investors). Building and managing hardware products is vastly more complicated than software products, hence the need for various skills in a hardware founding team is more prominent.

When it comes to climate tech hardware solutions, each piece of responsibility is so vast that a perfect founding team should have each of the areas of expertise ideally covered (sooner or later): Science, Engineering/Scale Up capacity, Generalist/Entrepreneurship, Industry Experience, Commercials/GTM, and Finance.

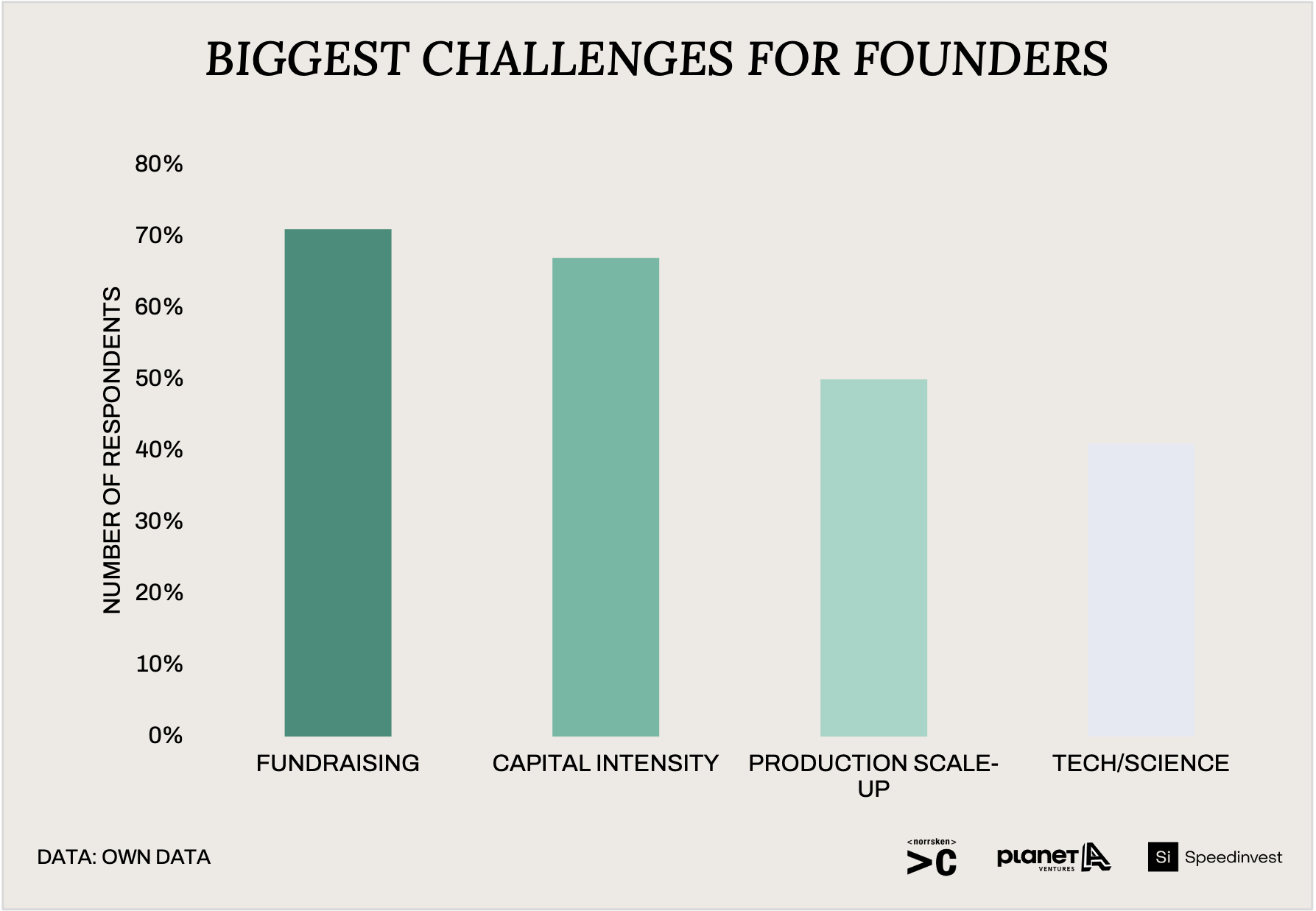

We need a new approach to solve the climate crisis

This playbook in itself is a ‘first-of-a-kind’ and we hope it's helpful for anyone interested in building or investing in climate hardware solutions. As we move forward, it's clear that solving the climate crisis with hardware innovations will require a new approach to funding and support. After all, approximately 70% of founders who participated in our survey said their biggest challenge is fundraising, followed closely behind by capital intensity. Clearly, there's a need for more investment in this area, along with better alignment between what climate hardware startups need and what investors are looking for.

While the challenges are significant, the potential impact of these technologies on the environment makes finding solutions to these hurdles more important than ever. At Speedinvest, we have supported more than 300 portfolio companies in exploring diverse technologies, business models, and funding sources for their ventures and we will continue to support these startups as they pave the way towards a more sustainable future. We see it as our job as Climate VCs to make sure we understand how to help founders navigate the complex journey of building a climate hardware company.